Within the space of 10 years, Aequs has established itself as one of the main suppliers for the French aerospace industry. Created in 1997 by two engineers, Aravind Melligeri and Ajit Prabhu, the company specialised in forging, machining and assembly of metallic parts for the aerospace and automotive industries, among others.

Today the group, renamed Aequs in 2014, reports annual sales of around $100m and employs 1,500 people around the world, mostly in the Belagavi Special Economic Zone (SEZ), 500km from Bangalore in southwest India, where the company headquarters is located.

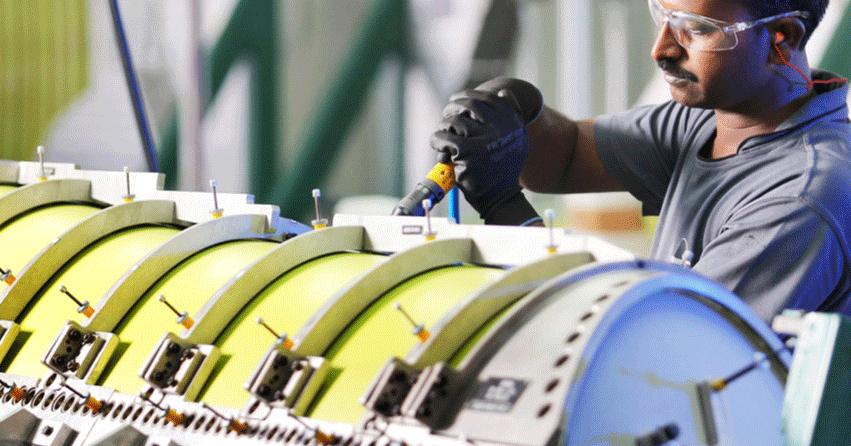

The company has been a subcontractor for Airbus since 2009, supplying titanium and aluminium parts for the A320. It also supplies parts for the A330, A350 and A380.

In February 2016, Aequs turned its focus to France with the acquisition of Sira, an SME with sales of €45m whose customers include Safran, Dassault and Thales. At the time, Sira had some financial problems, and Safran suggested it should find a new owner, recalls Steve Smith, who is Senior VP, Aerospace - Global Sales and Strategy. Aequs was already working with Safran, who asked them whether they would be interested in taking over the company. As it happens, Aequs was looking for take-over targets in Europe and the U.S. to be closer to its customers, explains Smith. By buying Sira, Aequs acquired control of four sites – in Besançon, Cholet, Aubigny and Paris – producing parts for Safran engines and landing gear.

Aequs’ Indian operations are based in a 250-acre SEZ with 21 factories, almost all of which belong to Aequs. Smith explains that one of the buildings houses the offices of engineering services provider Quest. Three other entities are joint ventures specialised in forging, assembly and other operations. These were created with Western partners, such as Magellan, Saab and Aubert & Duval. The partnerships are the result of reforms introduced by the Indian government in 2006, with the publication of the first Revised Procurement Procedure – an effort to encourage foreign companies to invest in India and collaborate with local aerospace industry.

Aequs currently has no recruitment plans for its French operations. Smith says the sites are operating at 50-70% of capacity and the priority is to boost production and sales. He notes that the decline in orders at the time of the take-over has been halted. When the customer base starts expanding, he says, there could be a need for new recruits, but for now it is still premature.

Nor is there any question of moving operations offshore. The French operation is seen as complementary to production facilities in India. Complex production takes place in France, while less complex work is performed in India. The advantage of spreading production across different sites is that the company can meet a broader range of requirements, says Smith. It also simplifies subcontracting arrangements, he notes, as customers can rely on a single supplier for a wide range of parts.

This is the key to the diversification strategy of Aequs. In November 2014, CEO Aravind Melligeri said that the group would invest $100m through 2020, and Aequs is continuously on the lookout for targets in France and elsewhere. The signature of the Indian Rafale contract in September 2016 could also herald new opportunities, since Rafale Team companies must invest 50% of the contract value in India. For now, however, no concrete plans have been announced. “It’s still too soon,” says Smith.